In the dynamic world of entertainment and business, the decision to invest in new equipment is a critical one. For family entertainment centers, trampoline parks, retail spaces, and even corporate offices, adding a new attraction must be more than just a novelty; it must be a sound financial decision. The rise of activate games—interactive, high-tech playgrounds that blend physical activity with digital challenges—presents a unique opportunity. But to capitalize on this trend, business owners must first understand the financial fundamentals: specifically, the Return on Investment (ROI) and the Payback Period for activate games equipment.

This article will break down how to analyze the profitability of such an investment, providing a clear roadmap to help you justify the cost and project a timeline for when your new attraction will start generating pure profit.

Understanding the Core Concepts: ROI vs. Payback Period

While often used interchangeably, ROI and Payback Period are distinct but equally important metrics for a financial analysis.

- Return on Investment (ROI): This is a performance metric used to evaluate the efficiency and profitability of an investment. It’s a percentage that tells you how much you’ve gained or lost on an investment relative to its cost. The formula is:ROI=Cost of Investment(Net Profit from Investment)−(Cost of Investment)×100A positive ROI means your investment is profitable, while a higher ROI indicates greater profitability. For activate games equipment, ROI considers not only the direct revenue from the games but also the indirect benefits, such as increased foot traffic, longer customer dwell time, and higher sales from other offerings (like food, beverages, and party bookings).

- Payback Period: This metric tells you how long it will take to recoup the initial cost of your investment. It’s expressed in units of time (months or years). The formula is:Payback Period=Annual Net Cash InflowInitial InvestmentThe Payback Period is an essential tool for liquidity analysis. A shorter payback period is generally more attractive as it means you recover your capital faster and can then reinvest that profit elsewhere. For a new activate games room, this is a powerful figure to present to stakeholders or lenders.

The Investment Equation: Breaking Down the Numbers

To perform a proper ROI and Payback Period analysis for activate games equipment, you need to account for both costs and revenues.

Key Costs to Consider:

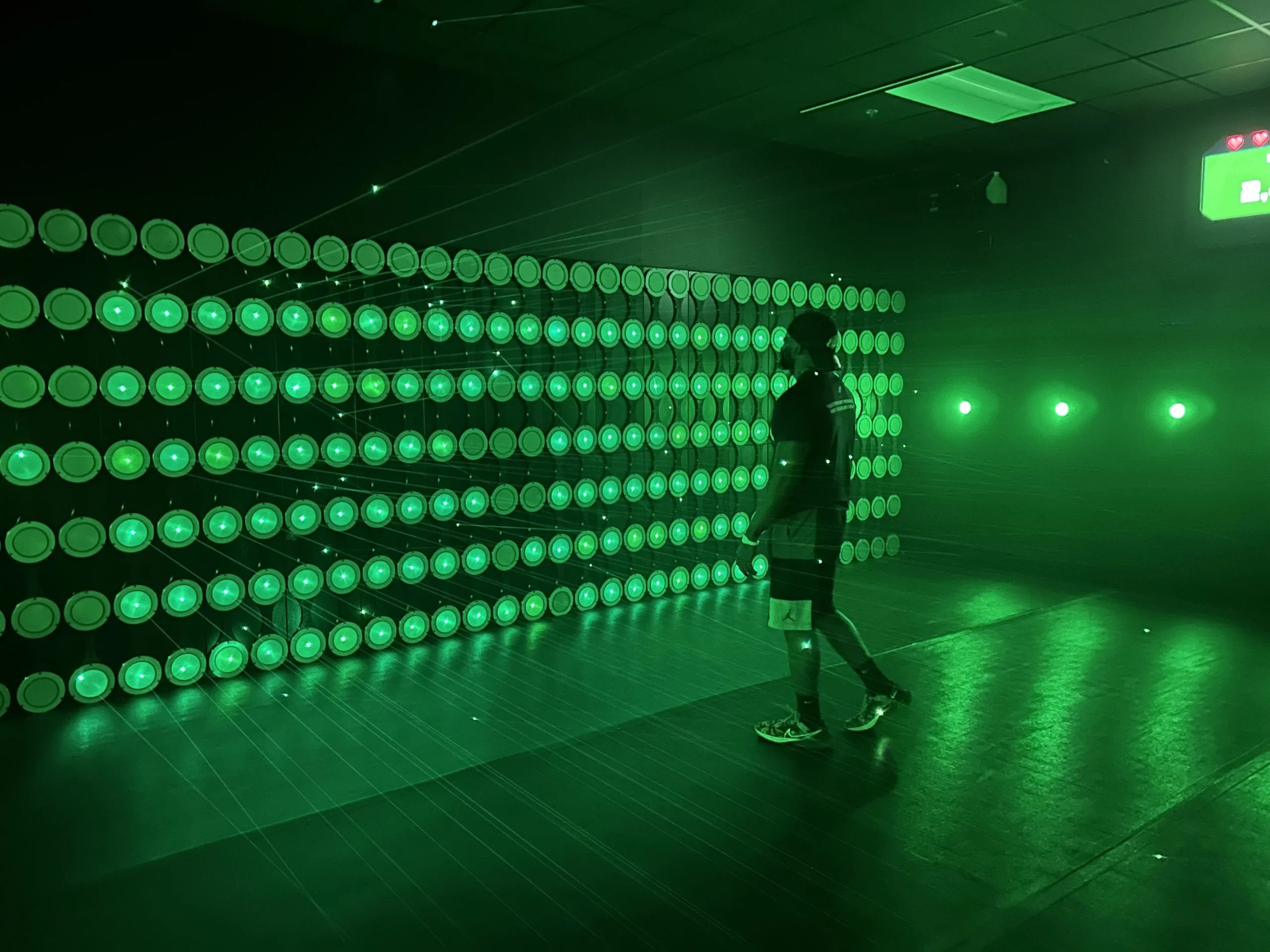

- Initial Capital Expenditure: This is the big number. It includes the cost of the interactive equipment itself, the physical build-out of the room (e.g., custom walls, lighting, flooring), installation fees, and any initial software licensing. This can range from tens of thousands to hundreds of thousands of dollars, depending on the scale and complexity of the setup.

- Ongoing Operational Costs: Don’t forget the recurring expenses. These include utilities (electricity for the equipment), maintenance and repairs, software subscription fees (if applicable), and labor costs for staff to operate or monitor the attraction.

- Marketing and Promotion: To maximize your return, you’ll need to invest in marketing. This includes launch events, social media advertising, and other promotional activities to get the word out.

Key Revenue Streams:

- Direct Revenue from Game Play: This is the primary revenue source. It’s calculated based on the price per game session and the projected number of players per day. For example, a system from a company like Pixelverse might charge per 15-minute session, with multiple players participating at once.

- Increased Sales from Ancillary Offerings: This is a crucial, often overlooked, benefit. When you add a compelling new attraction, people stay longer and spend more. Increased revenue from concessions, merchandise, and other on-site amenities should be factored into your analysis.

- Group and Event Bookings: Activate games are a perfect fit for birthday parties, corporate team-building events, and school groups. The revenue from these high-margin, pre-booked events can significantly accelerate your payback period.

A Practical Example: Calculating Your Payback Period

Let’s illustrate with a hypothetical scenario for a family entertainment center adding a new activate games room.

- Initial Investment: $150,000 (Equipment, installation, and build-out)

- Projected Daily Revenue:

- Direct Game Play: Assume 75 players per day at an average of $15 per session. That’s $1,125 per day.

- Ancillary Revenue Boost: The new attraction increases overall sales by 10%, generating an extra $200 per day.

- Total Daily Revenue: $1,325

- Projected Annual Operational Costs: $25,000 (Maintenance, utilities, etc.)

Step 1: Calculate Annual Net Cash Inflow

- Annual Gross Revenue: $1,325/day * 365 days = $483,625

- Annual Net Cash Inflow: $483,625 – $25,000 = $458,625

Step 2: Calculate Payback Period

- Payback Period = $150,000 / $458,625 ≈ 0.327 years

- To convert to months: 0.327 years * 12 months/year ≈ 3.92 months

In this simplified example, the payback period is less than four months. This is an incredibly short time frame, demonstrating the rapid return potential of a well-executed activate games investment. Of course, real-world numbers will vary based on your location, marketing efforts, and operational efficiency, but this model provides a solid framework for your own analysis.

Beyond the Numbers: The Intangible ROI

While the formulas for ROI and Payback Period provide a clear financial picture, it’s essential to recognize the intangible benefits that contribute to long-term success. These “soft” benefits are a critical part of the overall ROI:

- Enhanced Brand Reputation: An innovative activate games attraction positions your business as a modern, cutting-edge destination.

- Increased Customer Loyalty: A memorable and unique experience fosters a deep connection with your audience, encouraging repeat visits and brand advocacy.

- Viral Marketing Potential: The highly visual and social nature of activate games makes them perfect for social media. Customers often share their experiences online, creating a powerful engine of free, user-generated marketing.

Conclusion: A Smart Investment for a Modern Market

The decision to invest in activate games equipment is more than just about adding a new piece of hardware; it’s about investing in an experience that drives revenue, loyalty, and brand growth. By performing a thorough ROI analysis and understanding the potential for a rapid payback period, business owners can confidently move forward with a strategic investment that will pay dividends for years to come. In an industry where innovation is key, a smart investment in active entertainment equipment can be the deciding factor that sets you apart from the competition.